OnePlus is a serious participant within the Indian smartphone market, providing a variety of units, from flagships to midrange telephones just like the new Nord CE 4. Nevertheless, the image throughout North America seems to be fairly completely different and, in its present state, a bit unclear. With a restricted number of telephones out there and the shortage of main provider help, it stays to be seen how the corporate will retain its identification in a smartphone market dominated by Samsung and even smaller gamers like Motorola.

OnePlus’ journey within the U.S. has been a story of sudden occasions. The corporate just lately launched the OnePlus 12R in North America, a higher-mid-range telephone from the corporate’s R-series, a line that beforehand wasn’t offered within the U.S. That mentioned, a sure strategic shift introduced the telephone to the desk. Over time, the corporate’s technique has continued to evolve primarily based on its target market, and its choices have expanded with its first Put on OS smartwatch, a high-end foldable, and its first pill.

OnePlus’ versatile technique

Ten years in the past, the corporate marketed itself as a world model as a substitute of a China-based model. It was often known as a ‘Flagship killer,’ providing telephones with high-end options at a lower cost than established giants like Samsung and Apple. Extra just lately, it pivoted to a 1+4=X strategy, specializing in a single flagship telephone providing premium options in its design, show, digital camera, and battery whereas increasing into a wide range of different merchandise like wearables and sensible TVs.

“OnePlus is a younger and nimble participant out there and understands the necessity to stay versatile and handle market wants,” mentioned Maurice Klaehne, senior analysis analyst at Counterpoint Analysis.

As such, OnePlus has determined to rebrand itself as an “ecosystem builder,” providing a spread of units past telephones, just like the current OnePlus Watch 2 and the OnePlus Pill.

Anshel Sag, a senior analyst at Moor Insights & Technique, says that OnePlus needs to supply a “halo” impact “with a wholesome household of inexpensive units just like the 12R and Nord sequence. They’re additionally constructing an ecosystem of merchandise just like the smartwatch and pill across the telephone management expertise.”

Not like different Chinese language telephone manufacturers which might be usually pitted towards one another, OnePlus needed to create a major presence as a world telephone producer.

It succeeded in India, changing into the fastest-growing smartphone model in 2023, with 68% YoY progress. Sag attributed OnePlus’s success in India to its sturdy neighborhood and model recognition.

The U.S., nonetheless, was a more durable shell to crack “as a result of it requires much more advertising {dollars} in addition to provider involvement, and simply certifying on carriers isn’t sufficient, despite the fact that it’s costly,” Sag added. Mobile carriers rule the smartphone market within the U.S., and most of the people depend on these carriers to get new units yearly. Solely in 2018 did OnePlus companion with T-Cell to launch considered one of its best-selling devices, the OnePlus 6T.

Promoting a telephone in the USA requires an enormous advertising push and deep provider involvement, which could be costly.

OnePlus stored up its partnership with T-Cell for a while, with the OnePlus 7 Professional and different units being unique to the provider. Nevertheless, the partnership hit a rocky patch when the OEM determined to not launch the OnePlus 11 on T-Cell and as a substitute promote the flagship telephones unlocked through retailers like Greatest Purchase and Amazon. It’s speculated that there have been disagreements surrounding gadget timelines and that T-Cell needed to maintain telephones on its cabinets longer than OnePlus was prepared to. It additionally had a short gig with Verizon in 2020, however that additionally ended swiftly.

Whereas its flagship telephones didn’t appear to make a lot headway within the U.S. market, the corporate launched its budget-focused Nord N sequence telephones. OnePlus benefited from its provider partnership with T-Cell and the introduction of the Nord N10, N100, and N200 5G again in 2021, adopted by newer units just like the Nord N300 5G in 2022. Nevertheless, as of now, solely the Nord N30 is obtainable via the provider, that means shoppers must go elsewhere for different OnePlus fashions.

After we examine the Indian OnePlus web site to that of the North American one, there’s an apparent distinction. In India, the corporate provides a number of 5 flagship telephones and three Nord sequence telephones. On the identical time, the U.S. web site sees slim selecting with solely a complete of 4 telephones: the OnePlus 12 and 12R, the OnePlus Open, and the Nord N30.

Regardless of the slim choices, the corporate is working to make its telephones extra attractive towards heavy hitters, notes Klaehne. “Nonetheless, the corporate is providing large reductions on its units via the OnePlus retailer and different retailers via a trade-in program, which has been an effective way to entice prospects.”

A spokesperson from OnePlus advised Android Central that the corporate “tailors its product portfolio primarily based on completely different client calls for within the varied areas.” With the U.S. market dominated by premium gamers like Samsung and Apple, it’s clear OnePlus needs a chunk of that pie. In the meantime, OnePlus refused to touch upon how the sub-flagship 12R was fairing in North America, though it’s nonetheless fairly early.

Way forward for OnePlus within the US

In an interview with Forbes in 2023, OnePlus’s North American CEO, Robin Liu, mentioned that the corporate’s mission is to concentrate on merchandise that give prospects one of the best expertise. “We’re additionally focusing on a special viewers—spreading our model consciousness to extra customers. It would take a while as a result of it prices loads (of cash and energy). We’re additionally working along with our retail companions to increase our merchandise to a bigger viewers.”

Whether or not or not OnePlus will achieve making a dent within the North American market stays up within the air. Nonetheless, in line with the corporate, it is going to proceed to convey “high-end flagship smartphone units to the North American market at an inexpensive and aggressive value level.”

Sag reiterated that the Chinese language OEMs have the toughest time stepping into the market, which is the largest problem he sees for OnePlus. This notion should have an effect on OnePlus within the U.S. as tensions proceed to have an effect on relationships. “Huawei is the before everything. You don’t see plenty of TCL or ZTE anymore, and it’s the identical with Oneplus.”

Klaehne factors out that if OnePlus can even enter different markets, OPPO could have a more durable time getting into.

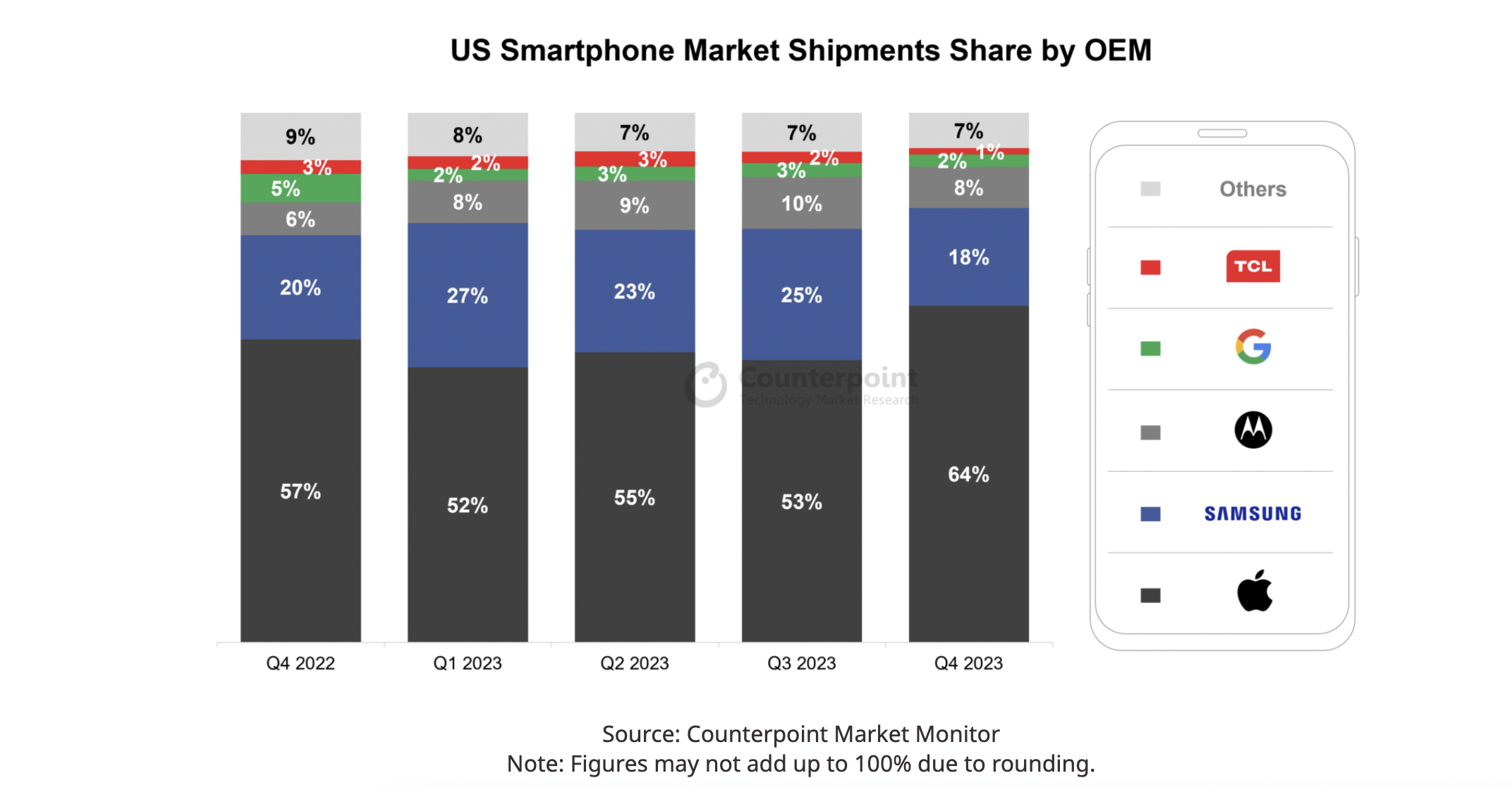

Data from Q4 2023 exhibits that whereas Samsung and Motorola held 18% and eight% of the U.S. market, respectively, OnePlus remained relegated to the ‘different’ class of telephones, which contributes to eight% of total gross sales. For context, TCL and Google managed to squeeze 1% and a couple of% of the market, respectively.

The dominance of Apple, Samsung, and, to an extent, Motorola/Google within the U.S. market has been difficult for OnePlus within the provider market, particularly with restricted mindshare right here in comparison with different areas. The U.S. market is difficult to penetrate because it’s so carrier-dominated, margins are low, and carriers usually have particular necessities for SKUs and specs.

“For continued success, OnePlus ought to concentrate on its ecosystem strategy and supply shoppers with a powerful worth proposition mixed with clear messaging and cohesive product line,” Klaehne mentioned.